For past two to three days people are talking a lot about Boston Properties, Inc. (BXP) in the stock market because it’s been doing really well lately in the market. The company’s stock, BXP, has been going up a lot, so investors are keeping a close eye on it. People seem to feel good about BXP stock overall, according to different analysis and studies. This positive feeling suggests that investors believe Boston Properties, Inc. will do well in the future, along with its stock. But it’s important to look deeper into why people feel this way and understand more about how BXP is doing in the market overall.

Understanding Stock Sentiment

Stock sentiment means how investors feel about a certain stock or the market as a whole. It shows how traders and investors feel overall, which affects what they decide to buy or sell. Many things can affect stock sentiment:

Definition Of Stock Sentiment:

Stock sentiment is a measure of how investors feel about a stock at a particular point in time. It is often based on factors such as recent performance, news, and market trends rather than fundamental analysis of a company’s financial health.

- Technical Indicators: These are statistical analyses of past market data, primarily price and volume, used to forecast future price movements. Technical indicators help traders assess trends, momentum, and market psychology, thus influencing stock sentiment.

- News and Events: News about a company, industry, or broader market can significantly impact stock sentiment. Positive news such as earnings reports, product launches, or favorable regulatory changes tend to boost sentiment, while negative news like lawsuits, management changes, or economic downturns can dampen sentiment.

- Price changes and trading volume: Price movements and trading volume provide valuable insights into investor sentiment. Rising prices on high volume suggest bullish sentiment, indicating optimism and confidence among investors. Conversely, falling prices accompanied by increased trading activity may signal bearish sentiment, indicating fear or uncertainty.

- Options trading signals: Options trading involves contracts that give investors the right to buy (call options) or sell (put options) a stock at a predetermined price within a specified timeframe. The ratio of call options to put options, known as the put/call ratio, can indicate market sentiment. A high put/call ratio suggests bearish sentiment, while a low ratio indicates bullish sentiment. Additionally, changes in options trading activity can provide valuable insights into investor expectations and sentiment shifts.

Current Status of BXP Stock

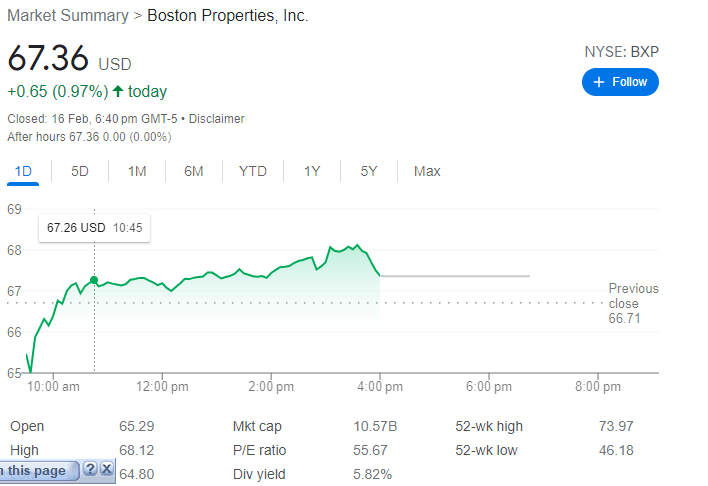

On Friday, February 16th, the stock of Boston Properties, Inc. (BXP) is being traded at a price of $67.44. This shows an increase of $0.73, which is about 1.09%, compared to the last closing price of $66.71. During the day, the stock’s price went up and down, reaching as low as $64.81 and as high as $67.56. Even though the price changed throughout the day, overall, the trend was positive, showing a small increase in BXP stock.

If we focus on trading volume, the current activity for BXP stock is relatively light. As of the latest update, the total volume of shares traded stands at 667,195. This figure is notably lower than the average trading volume for BXP, which typically sees around 1,636,860 shares traded on a regular basis. The comparison between the current trading volume and the average volume provides insights into the level of investor interest and activity surrounding BXP stock on this particular day.

Overview of Boston Properties, Inc.

Boston Properties, Inc. owns lots of properties, more than 200 in different location. Altogether, these properties have about 53 million square feet of space that people can rent. Most of the properties are offices buildings, which are in big cities like New York, Boston, San Francisco, Los Angeles, Seattle, and Washington, D.C. This shows that the company is really important in these big cities. Besides offices, Boston Properties, Inc. also owns some retail stores, hotels, and houses. This mix of different kinds of properties helps them make smart investments. They can take advantage of opportunities in different areas while still focusing mainly on office buildings in busy cities.

Recap of BXP stock Performance

During the week, the company Boston Properties, Inc. did really well in the stock market. Their stock went up by a lot, about 5.08%. This made investors and experts pay attention because it shows that people feel positive about investing in Boston Properties.

On Friday, Feb 16, the stock continued to go up. It reached $67.44, which is $0.73 more than the price it closed at before. That’s about a 1.09% increase. Even though the price went up and down a bit during the week, overall, Boston Properties‘ stock has been doing well. This might mean there are good chances for people who want to invest in it.

If you found this article helpful, please share it with your friends. For more useful information like this, visit our website at wealth-news.com.

Also Read: Tom Hanks Almost Died Making ‘Cast Away’ What Happened On The Set Of ‘Cast Away’?

Also Read: Air Jordan 4 RM Release Date, Price, Design, Color

Also Read: Kelly Clarkson’s Touching Cover of ‘Save Me’ Moves Jelly Roll Get Emotional